Policy #1:

Your insurance through the Trust

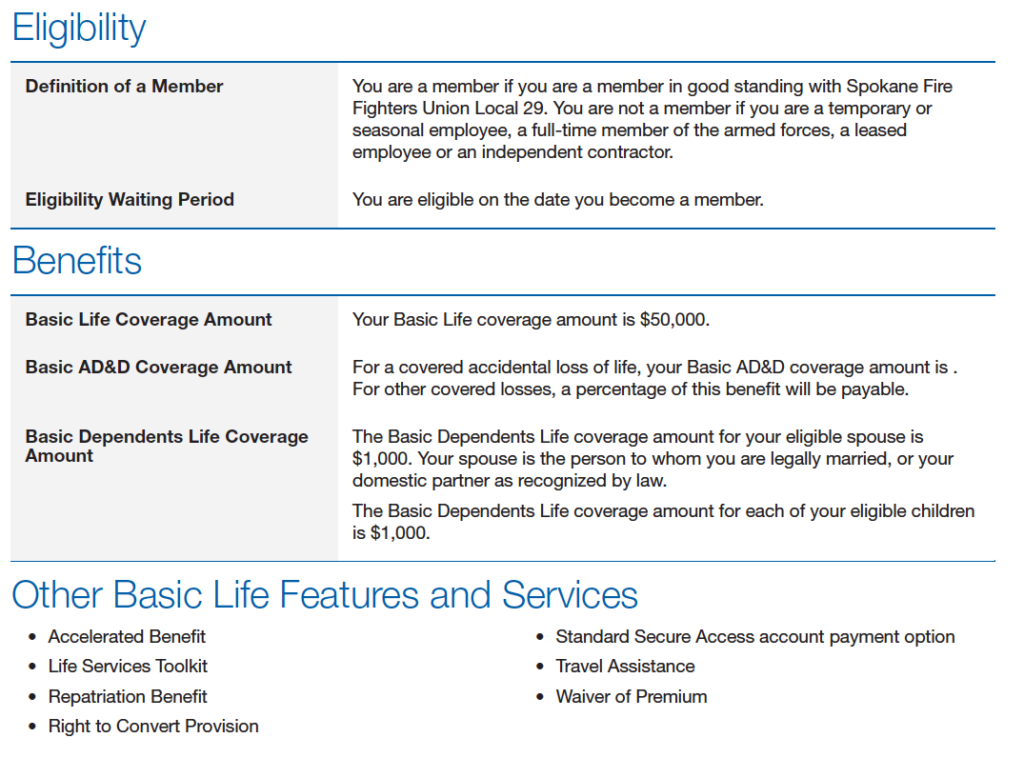

You are automatically enrolled in this insurance plan on the date you become a member of the Trust. This insurance coverage comes at no cost to you and is provided through the Trust and insured by The Standard. The policy includes basic coverage for you, your spouse, and dependent children (up to age 26). The only thing you need to do to manage this coverage is designate your beneficiaries.

Download the Standards Benefit Booklet

This page provides a brief description of the group Basic Life/AD&D and Basic Dependents Life Insurance policy sponsored by the Trust.

HOT TIP

Be sure your beneficiary designation is up to date. To designate or make changes to your beneficiaries, or for general questions about your plan, contact the Trust office at (888) 563-0665. Life insurance proceeds are payable to the last person you listed as your beneficiary, so check periodically and make changes if necessary.

Purchasing additional life insurance

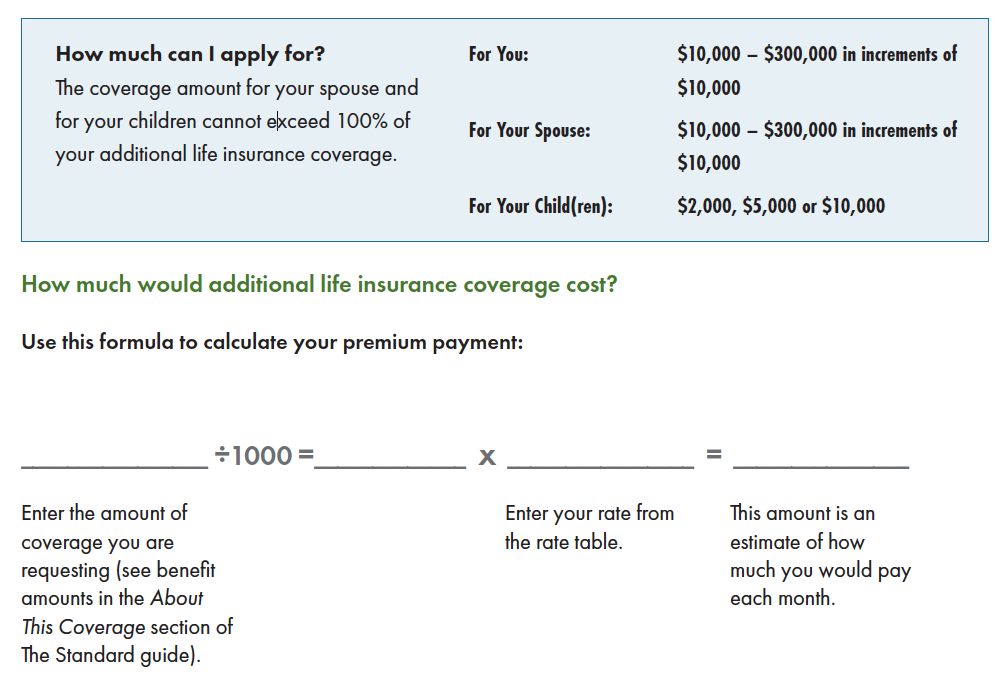

If you want more coverage than your basic life insurance plan provides, you have the option to purchase additional “Voluntary Life Insurance” for yourself, your spouse, and/or dependent children. You can increase or decrease this coverage over the years with life changes like marriage, divorce, or the birth of children.

You can apply for additional life insurance at any time. Begin by contacting the Trust Office, which will provide you with more information, an Enrollment Change Form, and a form for designating beneficiaries. They will also be able to tell you what documentation The Standard requires for purchasing additional life insurance. For example, if the coverage purchased is over $50,000 for yourself or over $20,000 for your spouse, you will need to provide Evidence of Insurance (EOI) and a Medical History Statement. To complete your medical history, visit: www.standard.com/mhs.

“How much life insurance do I need?”

After a death in the family, there are many unexpected expenses. Your benefits could help your family pay for:

- Outstanding debt

- Burial expenses

- Medical bills

- Your children’s education

- Daily expenses

The amount of insurance you need will depend on your unique circumstances, but consider how much would be needed to cover these and other types of expenses, and maintain your family’s standard of living.

The amount of insurance you need will depend on your unique circumstances, but consider how much would be needed to cover these and other types of expenses, and maintain your family’s standard of living.

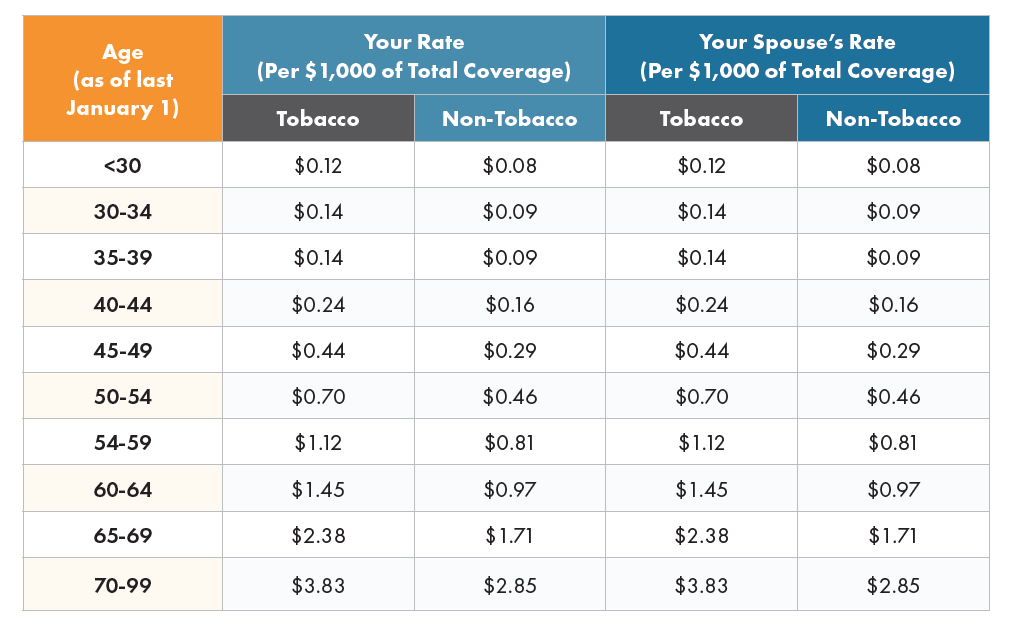

If you buy coverage for your spouse, your monthly rate is shown in the table below. Use the same formula to calculate the premium that you used for yourself, but use your spouse’s rate.

If you buy coverage for your child(ren), your monthly rate is $0.20 per $1,000, no matter how many children you’re covering.

Questions?

If you have changes or questions about your Trust-provided insurance plan, including purchasing additional life insurance, contact the Trust Office at: (888) 563-0665.